nh meals tax change

Additional details on opening forms can be found here. Chris Sununu in this years budget package which passed state government in June.

Chat Game Logo Template Psd Vector Eps Ai Illustrator Tech Logos Logo Design Template Social Media Design Graphics

The budget cuts the 5 interest and dividends tax by one percent a year starting in 2023 and eliminating it by 2027 so that really doesnt affect this budget much.

. The budget the State Legislature passed increases the meals and rooms tax from 8 percent to 9 percent effective July 1. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety RSA 261. As a result of these changes more than 90 of the revenue raised by the BET will now go directly to the Education Trust Fund.

The current tax on NH Rooms and Meals is currently 9. By law cities towns and unincorporated places in New Hampshire are supposed to get 40 of the meals and rooms tax revenue but that became less certain after the 2009 recession. NH Meals and Rooms tax decreasing by 05 starting Friday.

Nh meals tax change Tuesday March 8 2022 Edit. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. 1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting.

Another Favorite Author I Have Read All Of The Anna Pigeon Series Loved Them And Waiting For This One T Best Books To Read Worth Reading Stieg Larsson Books North Dakota Bismarck North Dakota Travel Nursing Bismarck North Dakota. Concord NH The. That means someone buying a 24 restaurant meal would pay 12 cents less.

This budget raises no new taxes or fees and is free of a sales or. Speaking of the rooms and meals tax the budget would cut that rate from 9 85 starting in January. The organizations has requested the.

Years ending on or after December 31 2025 NH ID rate is 3. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Starting Friday the states tax on rooms and meals was reduced from 9 to 85.

Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For additional assistance please call the Department of Revenue Administration at 603 230-5920. The House approved a bill that extends the rooms and meals tax to online platforms that coordinate private auto and short term rentals.

On March 16 2020 Chris Sununu- Governor of New Hampshire announced that the State of New Hampshire is prohibiting scheduled public gatherings over 50 people and transitioning restaurants and bars to mandatory offsite eating effective at close of business today- Monday March 16 2020. An additional 09 Medicare tax will be imposed on self-employment income in excess of 250000 for joint returns. If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920.

New Hampshire is one of the few states with no statewide sales tax. This budget strengthens the New Hampshire Advantage once more. Changes were made to the meals and rooms tax allocation formula that saw a smaller percentage going to towns and more money staying in the states general fund.

Law360 June 25 2021 704 PM EDT -- New Hampshires governor signed into law a two-year. Concord NH The New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and Rooms Rentals Tax rate will decrease by 05 from 9 to 85. Bill supporters say it will level the playing field with brick and motor establishments that collect the levy and remit it to the state.

Years ending on or after December 31 2027 NH ID rate is 0. New Hampshire careers in healthcare. According to the NH Lodging and Restaurant Association.

Meals Rooms Tax Revenue Sharing 12. Years ending on or after December 31 2024 NH ID rate is 4. Fillable PDF Document Number.

The state meals and rooms tax is dropping from 9 to 85. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001.

A 9 tax is also assessed on motor vehicle rentals. For more information on motor vehicle fees please contact the. NH Cuts Biz Rooms And Meals Taxes In 135B Budget.

The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. 7 meals tax in North Andover and 9 in Salem not included. Years ending on or after December 31 2026 NH ID rate is 2.

2022 New Hampshire state sales tax. AP Dining and staying overnight in New Hampshire just got a little bit less expensive. New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and Rooms Rentals Tax ratewill decrease by 05 from 9 to 85.

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire Meals Tax Restaurant Tax. A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. 125000 for married taxpayers filing separate.

Advertisement Its a change that was proposed by Gov. There are however several specific taxes levied on particular services or products. All restaurants and bars within New Hampshire are still able to continue offering food for.

Multiply this amount by 09 9 and enter the result on Line 2. A 9 tax is assessed upon patrons of hotels and restaurants on meals alcohol and rooms costing 36 or more. NH Meals and Rooms Tax.

The 2022-2023 budget set revenue. Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the customer receipt or check. All meals and rooms tax licensees should implement the necessary changes to their systems to reflect this change by tomorrow.

To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. Exact tax amount may vary for different items.

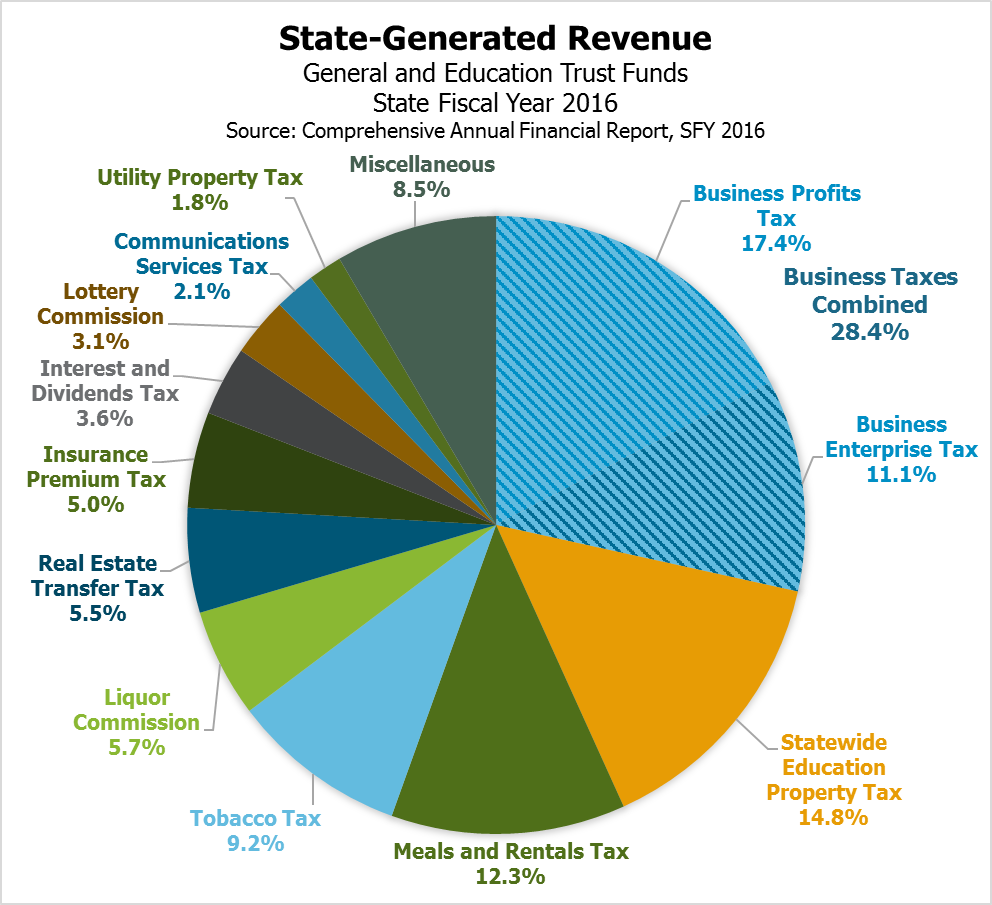

Revenue In Review An Overview Of New Hampshire S Tax System And Major Revenue Sources New Hampshire Fiscal Policy Institute

Historical New Hampshire Tax Policy Information Ballotpedia

Nh Fiscal Policy Institute Holds Panel To Address Food Insecurity

Nh Fiscal Policy Institute Holds Panel To Address Food Insecurity

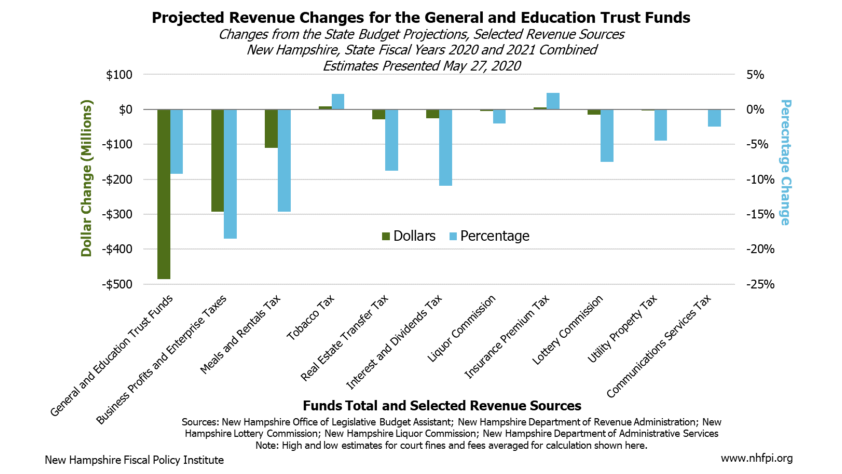

New Hampshire State Agencies Project Major Revenue Declines Nh Business Review

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Beef Tartar At Town Meeting Bistro Special Recipes Food Dinner Recipes

New Hampshire State Agencies Project Major Revenue Declines Nh Business Review

January 2014 Event Calendar Granite Restaurant Concord Nh Hotel Specials Easter Buffet Favorite Wine

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

Thanksgiving Buffet At Woodlake Country Club On November 28th Celebrate Thanksgiving With Family And Frien Champagne Vinaigrette Fruit Display Antipasto Salad

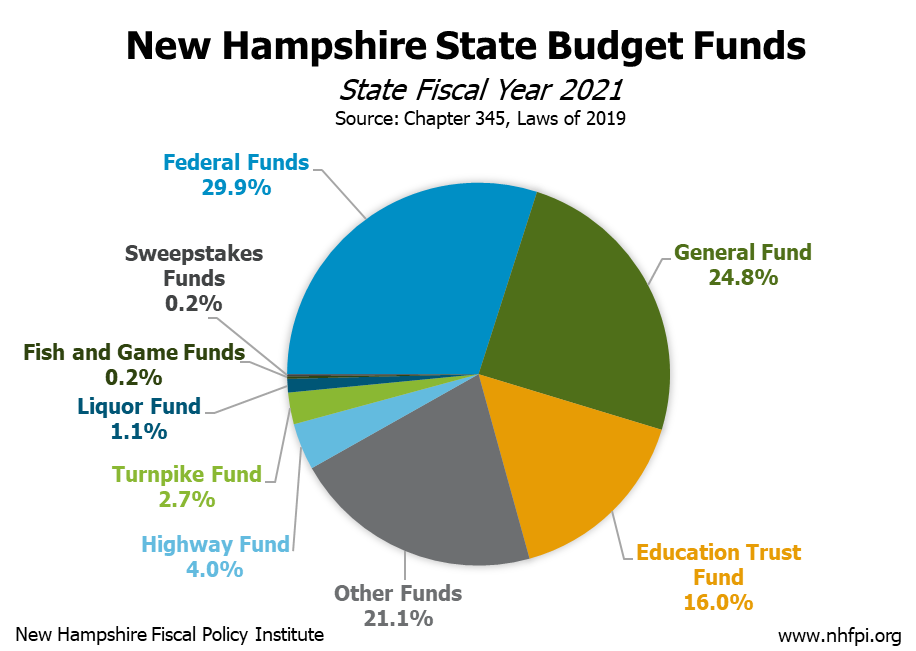

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Pin On Favorite Fast Food Places Fast Food

Atlanta Georgia Personal Chef Personal Chef Personal Chef Business Chef Craft

Nh Fiscal Policy Institute Holds Panel To Address Food Insecurity

New Hampshire Meals And Rooms Tax Rate Cut Begins

For Business And Private Events The Nh Cavalieri In Pisa Offers Three Multi Purpose Meeting Rooms Accommodating Up To Eighty People In A Modern And Relaxing A

Early Impacts Of The Covid 19 Crisis On State Revenues New Hampshire Fiscal Policy Institute